Unleash Your Trading Potential Today With Real Time Training

Real Time Training: Daily Brief & Real Time Set Ups

Learn to trade in Real Time by looking over the shoulder of a seasoned trader with over 15 years of market experience!

Our Head Trader John Fortune opens up his proven Day Trading and Swing Trading playbook with Daily Brief video updates each morning followed by Real Time Set Ups throughout the day in the members area

What’s Included in the Membership?

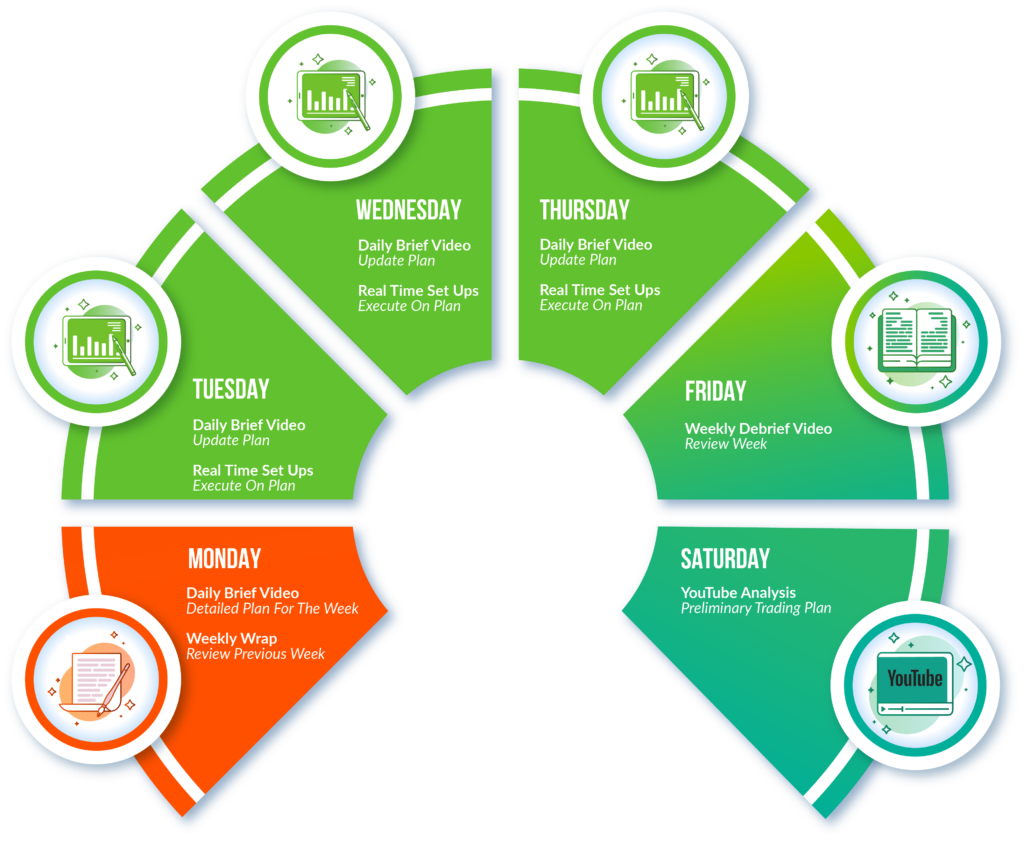

- Daily Analysis Videos from Head Trader John Fortune: every morning, Monday – Friday posted in your members area and available to watch On-Demand. Start your day with the guidance of a successful professional trader! (average video running time 30-minutes)

- Real Time Setups: Throughout the day, receive real-time trading set ups based on our Head Traders time tested Day Trading and Swing Trading strategy

How it works – The Get Me Trading Framework

1

Daily Market Brief (Planning)

Prepare like a professional each day as John outlines, and updates, his personal trading plan each morning in the Daily Brief video

2

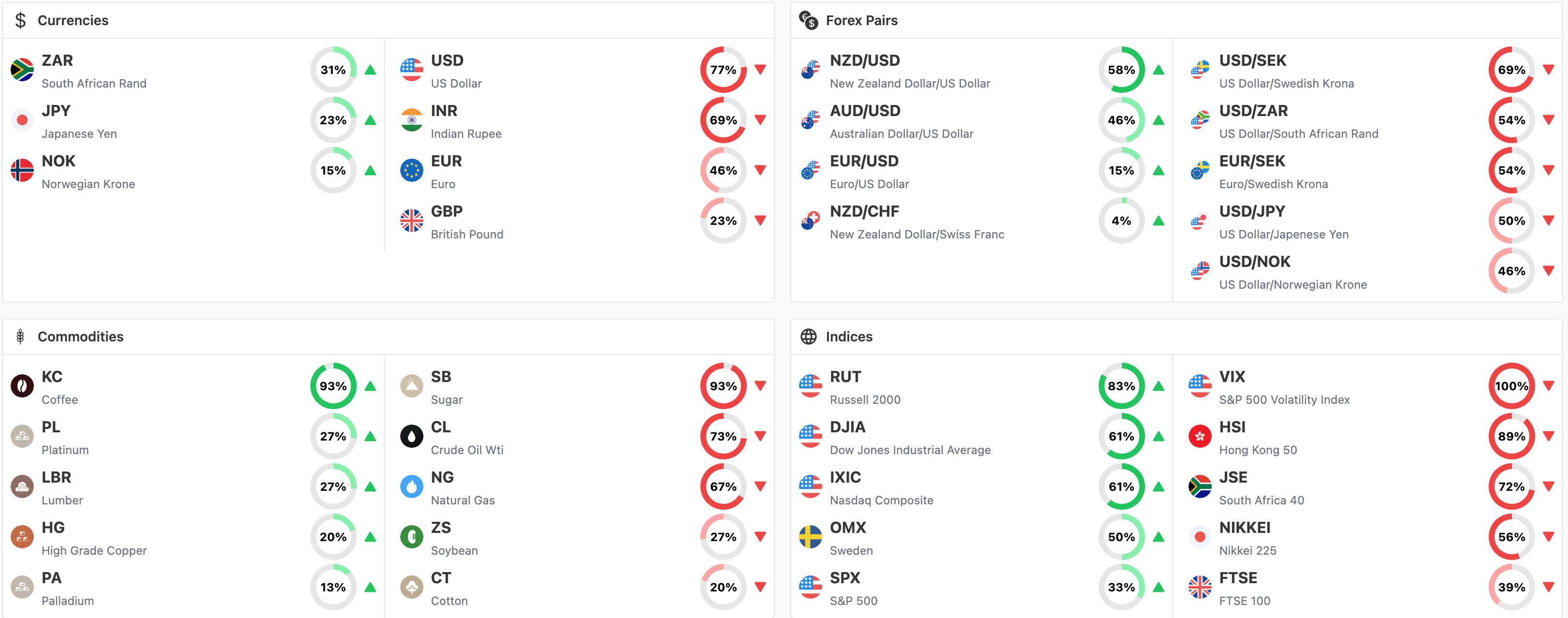

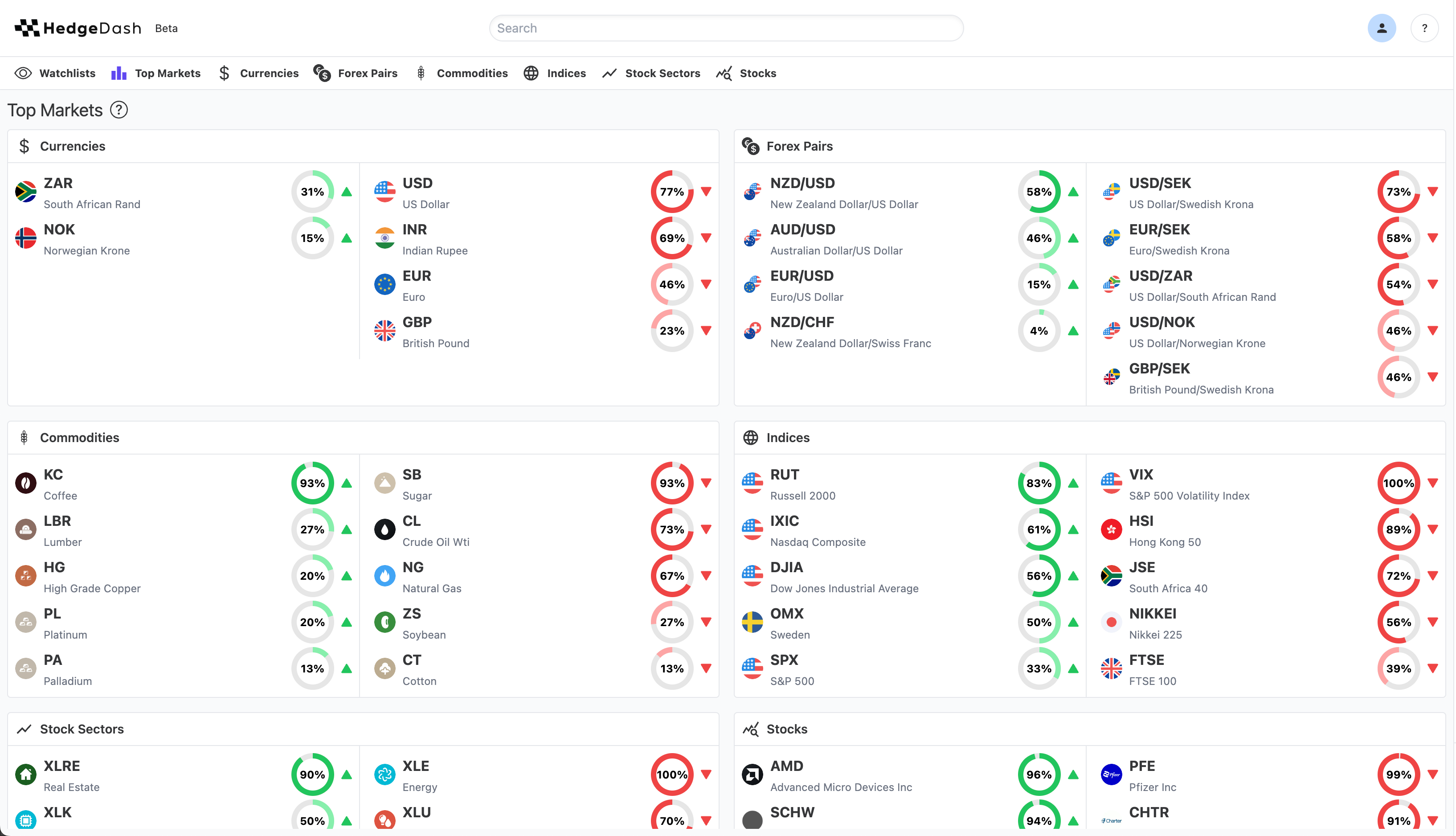

Quantitative Data Systems with Hedgedash (Asset Selection & Market Timing)

Using the cutting edge Hedgedash trading platform we isolate and identify the best opportunities in line with the evolving trading plan for that week. All GMT members have full access to Hedgedash via their GMT subscription

3

Real Time Set Ups (Execution of Plan)

Receive Real Time Set Ups in the members area based on the steps 1 & 2. All Real Time Set Ups come with with browser and email notifications

New!

A revolutionary suite of tools to take your trading to the next level